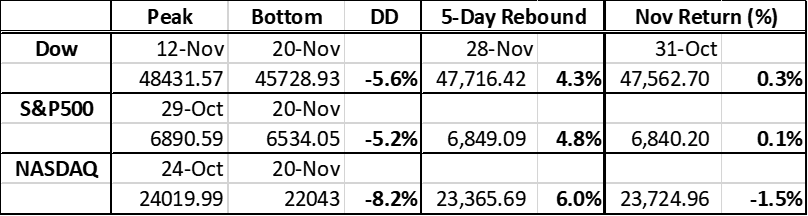

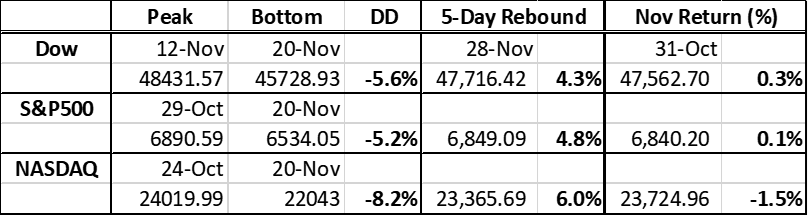

美股標普500指數連續7個月飆升39%後,終於在11月出現技術性調整(曾回調5.2%),但指數在上月最後5個交易日急速反彈,最終全月仍能升0.1%,延續連升紀錄。

儘管經歷三周驚心動魄的急跌,標指仍在6534點成功止跌回升,更展開高達315點的急彈,最終11月埋單計數共漲9點。值得留意是AI股王英偉達(NVDA)在11月急挫12.5%後,標指仍能錄得輕微升幅。

谷歌博通抵消其他科技股弱勢

納指在11月最後5個交易日也掉頭急彈,兼收復大部分失地,但受人工智能泡沫憂慮拖累,納指最終連升七個月後斷纜,上月共跌1.5%。除英偉達上月下挫12.5%外,Palantir(PLTR)急瀉16%,多數AI概念股同期跌幅介乎5%至15%。谷歌及其TPU供應商博通(AVGO),除了受惠巴菲特投資,配合Gemini 3.0史詩級成功發布,還有自主研發的AI晶片TPU發展勢頭佳等消息沖喜,抵消其他科技股的跌勢。

除AI泡沫憂慮外,11月市場震盪關鍵是利率政策預期快速轉變,特別是經濟數據好過預期,加上多位聯儲局官員鷹派言論,令12月減息機會率急降至不足30%。疲弱民間就業報告數據,加上紐約聯儲局主席言論偏鴿,令聖誕前減息機率回升至50%樓上。

儘管我仍認為下週四減息機率略低於五成,但市場預期減息升溫,刺激美股向上,更令道指上月中曾跌5.6%後喘穩,實現11月再升0.3%。

此次七個月以來美股最大調整,不單紓緩短期超買壓力,亦可解讀為延續今年12月以至明年升勢前的健康整固,尤其是2025年迄今美股升勢引發市場過熱的憂慮,截至11月底止,道指、標普與納指今年累計升幅分別為12.2%、16.5%與21%,略高於長期平均,但相較長期複合回報率卻仍未算偏高。考慮近月關稅、地緣政治、利率、宏觀增長、企業盈利等方面基本面持續好轉,升幅實屬合理。

事實上,三大指數連續第三年錄得雙位數升幅,但德銀投資者倉位指標仍處中性水平,高盛投資者始終對升勢保持謹慎。不過,無論2025年或2023至2025期間,「憂慮之牆」始終使投資者對股票配置略低於均值。

另一方面,11月初回調期間,反向ETF規模激增,顯示散戶與趨勢追蹤型CTA基金、波動率目標基金都齊齊拋售,但反而是一個不俗的逆向指標,預示市場至少已形成技術性底部,為未來12個月再創新高鋪路。

超買與技術調整壓力大幅紓緩

儘管中短期風險與波動仍然存在,但市場早前超買與技術壓力已大幅紓緩,令風險回報顯著改善。雖然12月不減息機會大,加上「大淡友」Michael Burry等持續唱淡AI股份,或抑壓年末股市表現,但對利率與AI的過度憂慮將在數周或數月內消退,有助帶挈股市2026年邁向新高。多數策略師最新預測顯示,2026年標指目標將升約10%,主要是基於預測盈利有13%升幅。

儘管月度預測向來變數大,但美股11月回調後,本月走勢有望好轉 ,明年前景更值得睇好,因利率與AI增長被過份憂慮,相信會在2026上半年或明年首季內消散。

November correction pave way for uptrend to extend in short & long run

The S&P500 index finally posted a 5.2% correction in November in for time in its 7-month 39% rally since April 8th bottom. Nevertheless, it rebounds swiftly in the final 4.5 trading days to close the month with a 0.1% gain and extend its winning streak to seven straight months. Despite a sharp & horrendous 3-week plummet, the benchmark index managed to bottom out at 6,534 and staged a 315-point rebound to end November 9 points higher. Even more surprising is that S&P edges up when Nvidia plunges 12.5% in November.

NASDAQ also rebound strongly in those 5 final trading days of November to recoup most lost ground but still lost 1.5% last month to break its 7-month rising streak on AI bubble fears. Palantir pace the drop with a 16% lost followed by Nvidia’s 12.5% decline and most AI stocks were down 5%-15% last month. Strong gains on Google & its TPU supplier Broadcom due to several good news Google including Buffet’s investment, epic success of Gemini 3.0 launch, & momentum on its in-house AI chip – TPU offset some damage from other tech shares.

Besides AI bubble fear, another key factor for November roller-coaster ride is the swiftly changing rate-cut chance. Some better-than-expected number and several hawkish US Fed official comments slashed the chance of a December cut from almost certain to less than one-third. Fortunately, a weak private payroll report and a dovish NY Fed Governor manage to boost the hope of X’mas cut back above 50%. Although I still see the odd of an easing next Thursday slightly below half, higher market estimation helps not only the S&P500 index but also the older Dow Jones Industrial Averages to recover its 5.6% mid-month drop to a small 0.3% rise for November.

These biggest pullbacks in 7 months ease the near-term overbought pressure and could be the healthy consolidation the market needs to extend its uptrend in December and 2026. Although 2025 so far seems quite strong with some people worried about excessive gains, YTD gains of Dow Jones, S&P500, & NASDAQ are 12.2%, 16.5%, & 21% at end November. These 11-month returns are surely above historic average but not that much higher than the long-term compound yearly return. Especially considering the favourable fundamentals last few months such as improving outlook on tariff, geopolitical, interest rate, macro growth, company earnings, & etc. Above mentioned 11-month gains are hardly irrational.